Many people believe that saving money is the ultimate financial goal. While saving is a crucial first step, it’s just one side of the coin. The real magic happens when you move beyond just saving and start investing. Over the long term, the difference between a saver and an investor can be staggering. Let’s explore the 10-year difference.

The Saver’s Journey

A saver typically puts money into a low-interest savings account, a basic checking account, or even just keeps cash on hand. While these methods offer security and liquidity, they offer very little in terms of growth. Your money essentially maintains its value, or even loses purchasing power over time due to inflation.

Let’s imagine a diligent saver who consistently puts away $200 per month.

- Year 1: $2,400 saved

- Year 5: $12,000 saved

- Year 10: $24,000 saved

Assuming a very modest interest rate of 0.5% per year (common for many savings accounts), the growth on this money would be negligible. After 10 years, our saver would have approximately $24,600. It’s a respectable sum, but it barely outpaces inflation.

The Investor’s Journey

An investor, on the other hand, takes that same $200 per month and puts it into assets that have the potential to grow over time, such as stocks, bonds, or mutual funds. While investing carries some risk, historical data shows that over long periods, the stock market tends to provide significant returns.

Let’s take our same $200 per month and assume an average annual return of 7% (a conservative historical average for the stock market, even considering market fluctuations).

- Year 1: $2,400 invested, grows to approximately $2,484

- Year 5: Cumulative investment of $12,000, grows to approximately $14,036

- Year 10: Cumulative investment of $24,000, grows to approximately $34,920

This is where the power of compounding truly shines. Not only is the investor earning returns on their initial contributions, but they are also earning returns on the previous returns. This snowball effect accelerates over time.

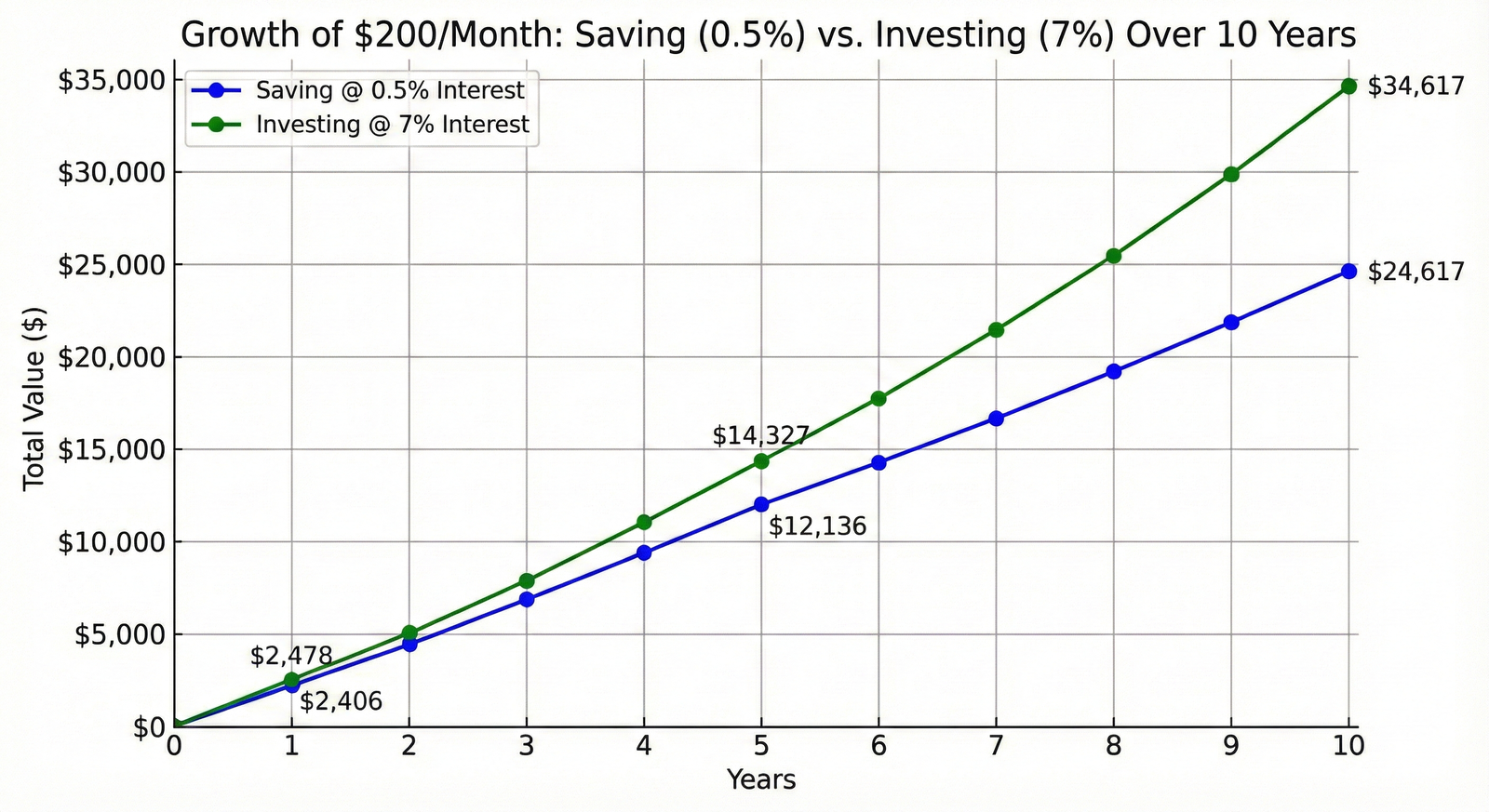

Visualizing the Difference

To truly grasp the impact, let’s look at a visual comparison of our saver and investor over a 10-year period.

The blue line represents the saver’s progress, showing a steady, linear growth based primarily on contributions. The green line, representing the investor, starts similarly but then curves upwards more dramatically, illustrating the accelerating effect of compound interest.

Key Takeaways for Investors

- Start Early: The earlier you start investing, the more time compounding has to work its magic. Even small amounts can grow significantly over decades.

- Consistency is Key: Regular contributions, like our $200/month example, ensure you’re continuously adding to your investment base.

- Embrace Risk (Wisely): Understand that investing involves risk, but a diversified portfolio and a long-term perspective can help mitigate it. Don’t let fear keep you from potential growth.

- Educate Yourself: Learn about different investment vehicles and strategies. Investorsleap.com is a great resource to help you get started!

Conclusion

While saving money is a financially responsible habit, transitioning from a saver to an investor is where true wealth building begins. The 10-year difference, as demonstrated, is substantial, and this gap only widens over longer periods. Don’t let your money sit idly; put it to work for you and watch your financial future transform.