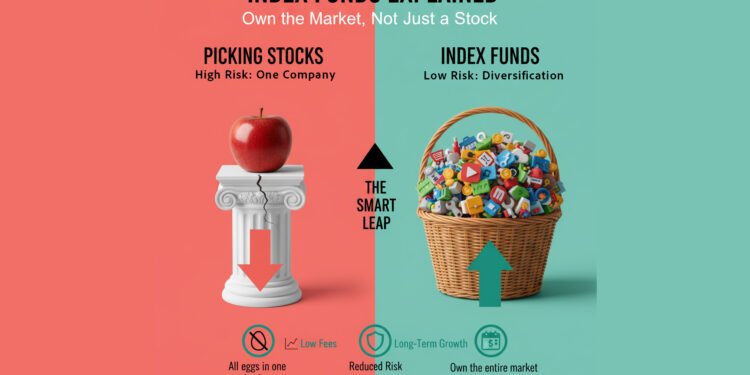

In our Investing 101 post, we introduced Index Funds as the ideal “simple vehicle” for new investors. But what exactly are these magical funds that allow you to own a piece of almost every major company without picking a single stock?

It’s time for a deep dive.

Think of the stock market as a vast ocean filled with thousands of different fish (individual stocks). Trying to pick the “best” fish at any given moment is incredibly difficult, even for seasoned professionals. Index funds offer a brilliant alternative: instead of trying to catch the fastest fish, they give you a net that catches a representative sample of all the fish.

This post will demystify index funds, explain why they’re so powerful, and show you why they might be the only investment you ever truly need.

🔍 What Is an Index Fund? (More Than Just a Basket)

At its core, an index fund is a type of mutual fund or Exchange Traded Fund (ETF) that holds a collection of stocks (or bonds) designed to mirror the performance of a specific market index.

What’s a Market Index?

A market index is simply a theoretical portfolio of stocks that represents a segment of the market. The most famous examples are:

- S&P 500: Tracks the performance of 500 of the largest U.S. companies (e.g., Apple, Microsoft, Amazon, Tesla).

- Dow Jones Industrial Average (DJIA): Tracks 30 large, publicly owned U.S. companies.

- Total Stock Market Index: Tracks thousands of U.S. companies, from the largest to the smallest.

- International Indices: Track companies outside the U.S. (e.g., MSCI EAFE).

So, an S&P 500 Index Fund literally buys a tiny slice of each of the 500 companies in the S&P 500, in the same proportions as the index itself. If the S&P 500 goes up 1%, your index fund goes up approximately 1%. If the index goes down, so does your fund.

🌟 The Unbeatable Advantages of Index Funds

Why do financial experts (including us at Investors Leap) rave about index funds for long-term wealth building?

1. Instant Diversification (The Ultimate Risk Reducer)

- Problem: If you buy stock in just one company, and that company goes bankrupt, you could lose everything.

- Solution: An S&P 500 index fund immediately diversifies you across 500 companies. If one or two companies falter, the overall impact on your portfolio is minimal because hundreds of others are hopefully doing well. This is crucial for managing risk.

2. Lower Costs (More Money Stays in Your Pocket)

- Problem: Actively managed funds employ highly paid managers who try to pick winning stocks. Their salaries and trading activities lead to higher fees (expense ratios) for you.

- Solution: Index funds are “passively managed.” They simply buy and hold what’s in the index. This means far fewer analysts, less trading, and significantly lower fees. Over decades, even a 1% difference in fees can cost you tens of thousands of dollars in lost returns.

3. Market-Beating Performance (Yes, Seriously)

- Problem: Despite countless hours of research, the vast majority of actively managed funds fail to beat the performance of their benchmark index (like the S&P 500) over the long term, especially after factoring in their higher fees.

- Solution: By simply matching the market, index funds consistently outperform most professional stock pickers over decades. You are essentially betting on the enduring power of the global economy, not on the genius of a single fund manager.

4. Simplicity (Set It and Forget It)

- Problem: Picking individual stocks requires constant research, emotional resilience, and a deep understanding of financial statements.

- Solution: Once you’ve chosen your index funds, your job is largely done. You continue to contribute regularly, and the fund automatically adjusts as companies enter or leave the index. It’s truly a “set it and forget it” approach that frees up your time and reduces stress.

💡 Investors Leap Tip: What to Look For When Choosing an Index Fund

When you’re ready to buy (in your 401(k) or Roth IRA), focus on these key factors:

- Low Expense Ratio: This is the annual fee you pay. Aim for funds with an expense ratio of 0.10% (0.001) or less. The lower, the better.

- Broad Diversification: For beginners, a Total Stock Market Index Fund (covering large, mid, and small companies) or an S&P 500 Index Fund is an excellent starting point. You might also add an International Stock Index Fund for global exposure.

- No-Load: Ensure the fund doesn’t charge a sales commission (a “load”) when you buy or sell it. Most popular index funds from brokerages like Vanguard, Fidelity, and Schwab are “no-load.”

🛑 Dispelling Index Fund Myths

- “They’re too safe/boring”: While they avoid single-stock risk, index funds are still fully exposed to market fluctuations. They offer market returns, which have historically been very good for long-term investors.

- “They don’t make you rich”: They absolutely do! The power of compounding, combined with consistent contributions to a low-cost index fund, is how millions of everyday millionaires have built their wealth.

- “You miss out on big winners”: While you won’t pick the next Apple, you will own a piece of it after it becomes a winner, as it will be part of the index. You capture the overall growth of the economy.

Your Leap into Smart Investing

Index funds are not a secret. They are a well-understood, historically proven path to wealth that anyone can access. By embracing the simplicity and power of index funds, you’re not just investing; you’re building a robust financial future, one broad market investment at a time.

You’ve made the leap from anxiety to action. Now, make the leap to smart, simple investing.