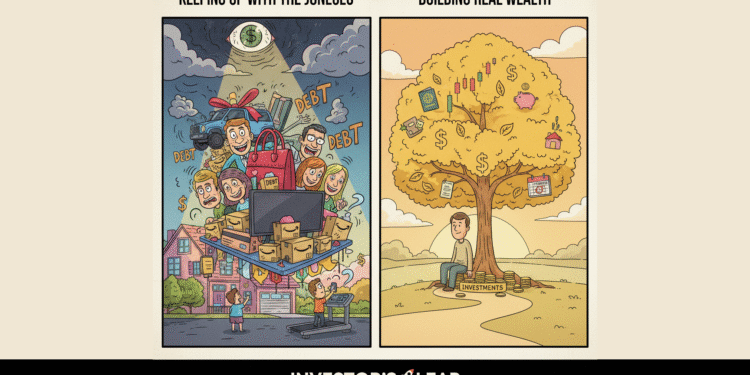

It’s the silent killer of budgets, the source of unnecessary debt, and the biggest thief of financial peace: The Comparison Trap, better known as “keeping up with the Joneses.”

In the age of social media, the Joneses are no longer just your neighbors. They are the curated feeds of your friends, the influencers with perfect kitchens, and the colleagues driving luxury cars. This relentless social pressure creates a phenomenon called lifestyle creep, where your spending automatically rises to match or exceed the perceived success of others, regardless of your actual needs or financial plan.

The hard truth? Trying to look wealthy often ensures you never actually become wealthy.

Ready to break free from the trap, silence the noise, and start building true wealth? Here is your guide.

The Illusion of Affluence: Why The Joneses Aren’t a Benchmark

The first step to stopping the comparison trap is understanding the illusion.

1. You See the Purchase, Not the Debt

When you see a neighbor’s new boat or your friend’s luxury vacation photos, you see the asset or the experience. You don’t see the monthly payments, the high-interest debt, or the drained savings account that might have funded it. True wealth is often silent; loud spending is often the sound of debt.

2. Everyone Has Their Own “Joneses”

The people you are trying to impress are likely trying to impress their own social circle. It’s a circular, never-ending game where the only real winner is the bank collecting interest on the loans.

3. Lifestyle Creep Is Silent

Lifestyle creep is the subtle process where increases in income lead to increases in spending on unnecessary items. You get a raise, and suddenly you “need” a higher cable package, more expensive takeout, or a bigger apartment. If your savings rate never increases alongside your income, you are simply spending more money to stay in the same financial place.

3 Strategies to Escape the Comparison Trap

Breaking the comparison habit requires intentional mental and financial shifts.

1. Redefine “Success” on Your Own Terms

You need a personal financial north star that is completely independent of external influence.

- Financial Goal Focus: True success is not a car or a house; it’s financial independence—the ability to choose how you spend your time. Write down exactly what that means to you (e.g., I will be financially independent by age 55).

- Create Your Wealth Statement: Change your internal dialogue from “I wish I could afford that” to “That purchase does not align with my goal of becoming financially free.”

2. Create Friction and Accountability

Make it harder to make impulse purchases driven by social pressure.

- The 72-Hour Rule: If you feel the urge to buy something expensive because someone else has it, impose a mandatory 72-hour waiting period. Often, the desire fades when the social pressure cools.

- Financial Visibility: Make your spending public (to your partner) or brutally honest (to yourself). Track every dollar. When you see exactly how much that “keeping up” purchase takes away from your savings goal, the temptation loses its power.

3. Change Your Inputs

Social media is the comparison trap accelerator. You must manage what you consume.

- Curate Your Feed: Mute or unfollow accounts that primarily showcase extravagant, aspirational lifestyles that trigger comparison spending.

- Follow Inspiring Wealth Builders: Replace those feeds with content from people who prioritize financial literacy, intentional saving, and long-term investment. They offer inspiration for building wealth, not displaying it.

🚀 Investor’s Leap: The Wealth-Building Gap

The Joneses spend money to look wealthy; true investors use that same money to become wealthy.

Calculate the Wealth-Building Gap. Take the money you would have spent this month trying to keep up (e.g., $150 on luxury clothes, $200 on excessive dining out, $50 on premium products). Immediately transfer that money—the gap—from your checking account directly into a high-growth investment vehicle, like a stock index fund. You are converting consumer desire into compound returns. Over time, that money will grow into the real, silent wealth that the Joneses only pretend to have.

The Joneses are chasing the illusion of happiness through consumption. You are chasing the reality of freedom through savings and investment. Stop looking over your shoulder at what others have, look straight ahead at your financial goals, and commit to the quiet, powerful path of building lasting wealth.

What is one item you will consciously not buy this week to stop chasing the Joneses?